UT DCC 882 2005-2024 free printable template

Show details

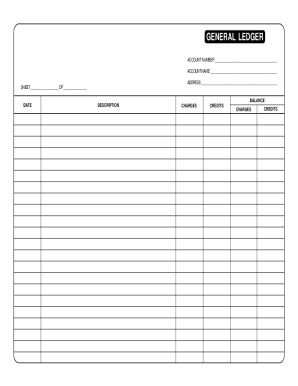

ATTACHMENT 3 State of Utah DCC FORM 882 HEAT Program Rev. 05/2005 SELF EMPLOYMENT LEDGER FORM Self Employed Person Case Business Name Month of Social Security Please complete both Part A and Part B. PART A. INCOME RECEIVED Please list all income received from your business in the above month. Entries can be made by jobs completed money received sales and commissions received daily cash receipts etc* You must prove your gross income by bringing in your books ledgers vouchers or other proof*...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your self employment form pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self employment form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit self employment form pdf online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit self employment worksheet pdf form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out self employment form pdf

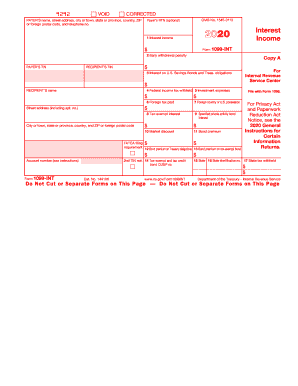

How to fill out taxes income tax:

01

Gather all necessary documents such as W-2 forms, 1099s, receipts, and records of deductions.

02

Determine your filing status - single, married filing jointly, married filing separately, or head of household.

03

Calculate your total income, including wages, self-employment income, rental income, and any other sources of income.

04

Determine your eligible deductions and credits, such as mortgage interest, student loan interest, and child tax credits.

05

Fill out the appropriate tax forms, such as Form 1040, 1040A, or 1040EZ, using the information from your documents and calculations.

06

Double-check all the information entered on the forms for accuracy.

07

Sign and date the tax forms before submitting them to the IRS.

08

Pay any taxes owed or arrange for a payment plan if unable to pay in full.

09

Keep copies of all submitted forms and supporting documents for your records.

Who needs taxes income tax:

01

Any individual with taxable income needs to file an income tax return. This includes employees, self-employed individuals, and those with investment income.

02

Certain thresholds determine if an individual is required to file taxes, based on factors such as age, filing status, and income level.

03

Even if an individual's income is below the filing threshold, they may still want to file a tax return to claim certain credits or refunds.

Fill ledger utah : Try Risk Free

People Also Ask about self employment form pdf

Where is income tax on 1040?

Where is your income tax on 1040 form?

How do I get my IRS income tax form?

What is the tax form for income tax?

What is Form 1040 income tax?

Is my W-2 a 1040 form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is taxes income tax?

Income tax is a type of tax imposed by the government on individuals or entities based on their total income and earnings. It is typically levied by both national and local governments to generate revenue for funding public goods and services.

Income tax is calculated on various sources of income such as wages, salaries, profits, dividends, rental income, and capital gains. The tax rates and brackets can vary depending on the country and the specific tax laws in place. Typically, higher income earners are subject to higher tax rates, while lower income earners may be eligible for tax credits or lower tax rates.

Income tax can be collected through different methods, including employers withholding tax from employees' paychecks, estimated tax payments made by self-employed individuals, or direct payments made by taxpayers filing their annual tax returns.

The revenue generated from income tax is used by governments to fund essential services and programs, such as healthcare, education, infrastructure development, defense, and social welfare initiatives.

Who is required to file taxes income tax?

Individuals who meet certain income thresholds are required to file income taxes. The exact threshold depends on various factors such as filing status, age, and type of income. Generally, if your gross income (income before deductions) exceeds the minimum filing requirement set by the Internal Revenue Service (IRS), you must file taxes. It is recommended to consult the IRS guidelines or a tax professional to determine if you are required to file taxes based on your specific circumstances.

How to fill out taxes income tax?

Filling out income tax forms can be a complex process, so it is important to gather all necessary documents and understand the requirements beforehand. Here is a general step-by-step guide to help you fill out your income tax forms:

1. Gather your documents: Collect all necessary documents such as W-2 forms, 1099 forms, receipts for deductible expenses, and any other relevant financial records.

2. Choose the correct form: Determine which tax form you need to fill out. Most individuals use Form 1040, but there may be other options like 1040A or 1040EZ depending on your specific situation.

3. Filing status: Indicate your filing status, which could be single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

4. Exemptions: State the number of exemptions you are eligible for, considering yourself, your spouse (if applicable), and dependents.

5. Income: Report all sources of income, including wages, self-employment earnings, rental income, interest, dividends, and any other taxable earnings. Ensure that the income reported matches the forms received, like W-2 or 1099.

6. Deductions: Determine if you will take the standard deduction or itemize deductions. Common itemized deductions include mortgage interest, state and local taxes, medical expenses, and charitable contributions. If you choose to itemize, provide the relevant details in the appropriate section.

7. Credits: Determine if you qualify for any tax credits, such as the Earned Income Credit (EIC), Child Tax Credit, or Education Credits. Enter the appropriate information and calculations.

8. Calculate taxes owed: Use the provided tax tables or tax software to calculate the amount of tax you owe based on your income, deductions, and credits.

9. Payments and refunds: Account for any tax already paid throughout the year, such as through employer withholding or estimated tax payments. Calculate if you owe additional tax or are eligible for a refund.

10. Sign and submit: Once you have completed all the necessary sections, sign and date your return. If filing electronically, follow the provided instructions. If filing by mail, attach any required forms or schedules and ensure proper postage.

Remember to review your completed tax forms for accuracy and consider seeking professional assistance if you have complex tax situations or questions.

What is the purpose of taxes income tax?

The purpose of income tax is to generate revenue for the government to support public services and programs. Income tax is a progressive tax, meaning that the rate at which individuals are taxed increases with their income level. The collected taxes are used to fund various government functions, such as infrastructure development, defense, education, healthcare, social welfare programs, public safety, and other essential services. Income tax also helps in redistributing wealth by imposing higher taxes on individuals with higher incomes, in an effort to reduce wealth disparity and promote a more equitable society.

What information must be reported on taxes income tax?

When filing income taxes, the following information must be reported:

1. Personal Information: This includes your full name, Social Security number (or taxpayer identification number), birthdate, and address.

2. Filing Status: You need to indicate whether you are filing as single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

3. Income: You must report all sources of income, including wages, salaries, tips, self-employment earnings, rental income, dividends, interest income, capital gains, unemployment compensation, and any other income received during the tax year.

4. Deductions: You can choose to claim the standard deduction or itemize deductions. If you choose to itemize, you need to report deductible expenses such as mortgage interest, state and local taxes, medical expenses, charitable contributions, and others.

5. Credits: Tax credits can reduce your tax liability. These may include the Earned Income Tax Credit (EITC), Child Tax Credit, Education Credits, Retirement Savings Contributions Credit, and others. You must report the credits you are eligible for.

6. Withholdings and Payments: You need to report any tax withheld from your income by your employer or other sources, as well as any estimated tax payments you made throughout the year.

7. Other Forms: If you have additional income or specific situations, you may need to report using additional forms. For example, if you are self-employed, you would need to fill out a Schedule C to report business income and expenses.

It is important to note that tax laws can vary by country, state, or jurisdiction. The above information generally applies to the United States, but it's crucial to consult the specific tax regulations and guidelines of your country or region when filing income taxes.

When is the deadline to file taxes income tax in 2023?

The deadline to file income taxes in the United States for the year 2023 would generally be April 17th, 2024. However, it's important to note that tax deadlines can sometimes be adjusted or vary based on a variety of factors, including holidays and other circumstances. It is always best to consult official sources or a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of taxes income tax?

The penalty for late filing of income taxes depends on the country’s tax laws and regulations. In the United States, for example, the penalty for filing taxes late can be calculated as a percentage of the unpaid taxes owed plus interest, which accrues on a daily basis. The penalty for late filing is typically 5% of the unpaid taxes for each month or part of a month that the tax return is late, up to a maximum of 25% of the unpaid taxes. However, if the taxpayer can show reasonable cause for not filing on time, the penalty may be waived or reduced. It is essential to consult the specific tax laws of your jurisdiction for accurate information on penalties for late filing of income taxes.

Where do I find self employment form pdf?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific self employment worksheet pdf form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit tax ledger template in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your self employment ledger template, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I edit utah self employment ledger on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing utah employment ledger form.

Fill out your self employment form pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Ledger Template is not the form you're looking for?Search for another form here.

Keywords relevant to paid tax form

Related to income tax

If you believe that this page should be taken down, please follow our DMCA take down process

here

.