UT DCC 882 2005-2025 free printable template

Show details

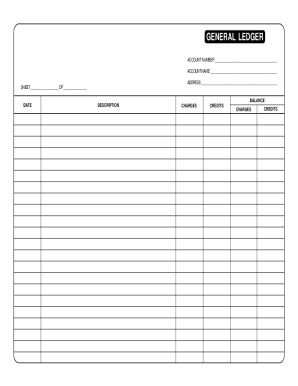

ATTACHMENT 3 State of Utah DCC FORM 882 HEAT Program Rev. 05/2005 SELF EMPLOYMENT LEDGER FORM Self Employed Person Case Business Name Month of Social Security Please complete both Part A and Part B. PART A. INCOME RECEIVED Please list all income received from your business in the above month. Entries can be made by jobs completed money received sales and commissions received daily cash receipts etc* You must prove your gross income by bringing in your books ledgers vouchers or other proof*...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign self employment form

Edit your self employment ledger template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your printable self employment form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit self employed form online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit soonercare self employment form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self employment income form

How to fill out UT DCC 882

01

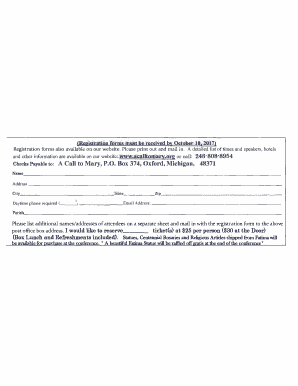

Obtain a copy of the UT DCC 882 form from the appropriate website or office.

02

Fill out the personal information section including your name, address, and contact information.

03

Provide details related to your educational background.

04

Indicate the purpose for submitting the form and any relevant case or reference numbers.

05

Review the form for completeness and accuracy.

06

Sign and date the form where indicated.

07

Submit the completed form to the designated office either electronically or by mail, as instructed.

Who needs UT DCC 882?

01

Individuals applying for certain educational programs or certifications that require documentation of their qualifications.

02

Students transferring from another institution who need to provide their academic records.

03

Professionals seeking licensure or accreditation in their field.

Fill

self employment worksheet

: Try Risk Free

People Also Ask about self employment record form

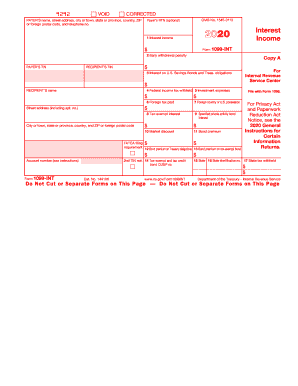

Where is income tax on 1040?

Where to find income tax on 1040 IRS Form 1040: Subtract line 46 from line 56 and enter the total. IRS Form 1040A: Subtract line 36 from line 28 and enter the total. IRS Form 1040EZ: Use Line 10.

Where is your income tax on 1040 form?

Income tax amount is the total of IRS Form 1040---line 22 minus Schedule 2---line 2.

How do I get my IRS income tax form?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

What is the tax form for income tax?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What is Form 1040 income tax?

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

Is my W-2 a 1040 form?

No, your W-2 and 1040 are different forms. A W-2 is the form that your employer will send to you with information on your income and tax rate, while a 1040 form is the form that you fill out and send to the IRS when filing your taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form for self employment?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific self employed forms and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit self employment forms in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your self employment documents, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I edit self employment cash income statement on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing printable self employment ledger.

What is UT DCC 882?

UT DCC 882 is a tax form used in the state of Utah for reporting certain tax liability information and credits.

Who is required to file UT DCC 882?

Businesses and individuals who have certain tax credits or liabilities as stipulated by Utah state tax laws are required to file UT DCC 882.

How to fill out UT DCC 882?

To fill out UT DCC 882, you need to provide your taxpayer information, detail any applicable tax credits, and report the necessary financial information as instructed on the form.

What is the purpose of UT DCC 882?

The purpose of UT DCC 882 is to facilitate the reporting of specific tax credits and liabilities to ensure compliance with Utah state tax regulations.

What information must be reported on UT DCC 882?

Information to be reported on UT DCC 882 includes taxpayer identification, details of tax credits claimed, and any other related tax liability information required by the state.

Fill out your UT DCC 882 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self Employment Income Worksheet is not the form you're looking for?Search for another form here.

Keywords relevant to self employment log sheet

Related to how to fill out a self employment form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.